Our speaker this month was Rhiannon Parker, a Fraud Protection Officer.

Rhiannon gave us a very interesting talk, including an insight into how fraudsters manipulate their intended victims. Fraud victims typically say ‘I’ve been so stupid’ and feel embarrassed that they have been persuaded to part with their money. Because of this, only about 20% of fraud is reported to the police.

The fraudsters are incredibly clever. They have designed their frauds to be successful. They target their victims for particular frauds and design scripts that will manipulate their victims towards to the intended outcome (i.e. so that the fraudster gets your money). This is their job.

In the first 6 months of the year, just over £570 million pounds was stolen by fraud in the UK. Fraud is 41% of all crime.

The Golden Rule for a possible victim is STOP, THINK. Take some time to consider things. Speak to a friend, relative, neighbour (or even pretend that you are doing this, to give yourself time to think).

Top Tips

Back up your data regularly

Have a strong and unique email password (80% of fraud is a direct result of email being hacked) e.g. 3 random words with some of the letters replaced by numbers or symbols.

Use two factor authentication, with the one-time passcode sent as an SMS rather than email

Keep your software up to date

A Typical Fraud

The victim will receive a request, out of the blue.

Is the person asking for personal information, e.g. a PIN code? (they might ask bit by bit, e.g. first characters 1 and 3, then a bit later, sorry I meant characters 2 and 4)

Have you ‘won a prize’ for a competition you have never entered?

Does the request introduce a time pressure? (it’s urgent, it’s an emergency, I need it today)

Is the request very generic? (they often send the same request to 100s of people so it is usually generic)

“Hi Mum” scenario

You get a text/message: “Hi Mum, I’ve lost my phone, I need some money quickly, it’s an emergency. I need £100”

If you don’t have children, you would probably ignore this! If you do have children: Why have they texted rather than called you? Don’t believe the ‘lost/stolen phone’ scenario without checking. Just call their number to speak to the actual person.

Does the text contain any personal information, e.g. your child’s name, or is it very generic and could apply to anyone? Consider creating a ‘family password’ – a name/place/nickname etc that the whole family would know which would confirm that the call was legitimate.

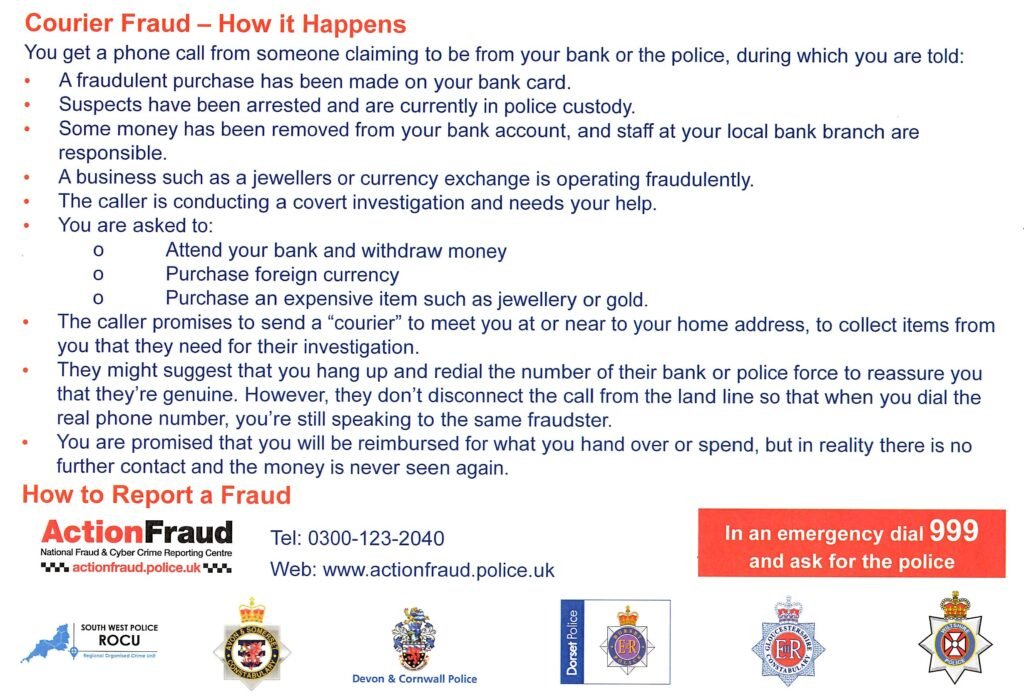

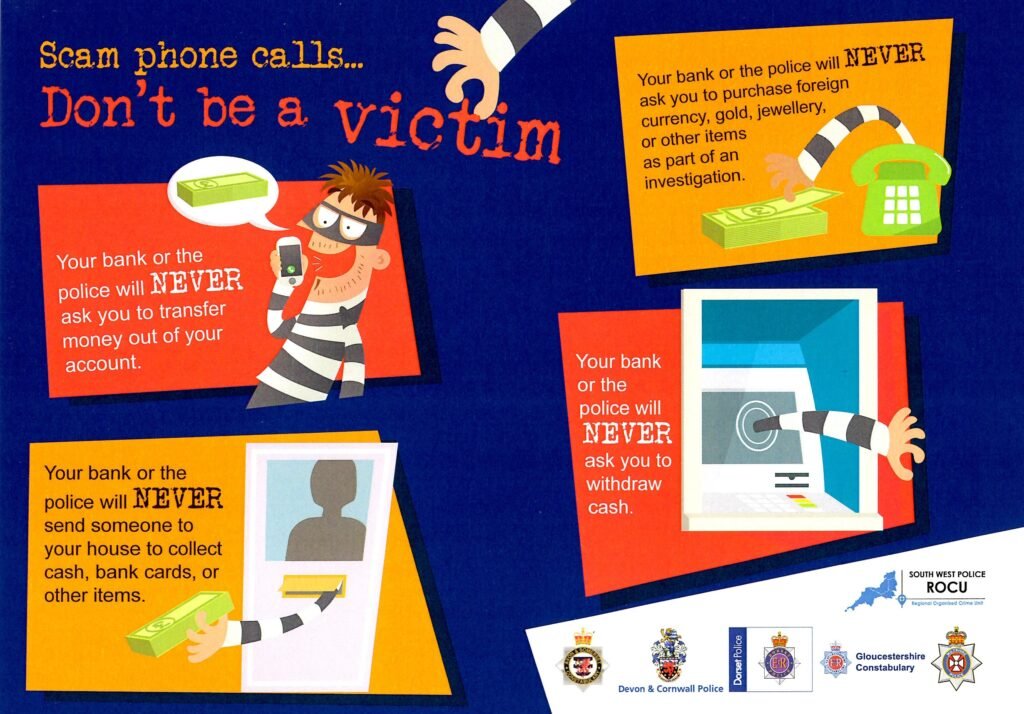

Cash/Courier scenario

Someone calls you, pretending to be the bank or the police. You are asked to help with their investigation. They make you feel guilty if you don’t help – the whole investigation will fail.

They ask you to go to the bank and extract a large amount of cash, and groom you to tell lies to the bank staff. They ask you to put the cash in an envelope and maybe to add your debit card (they will probably have got your PIN code from you already).

Do not trust them allowing you to phone the bank/police to check – they may well stay on the line, mimic dial tones and then pretend to be the bank/police themselves. They send a courier to your home to pick up the envelope. Your money is gone, never to be seen again.